Maximizing Returns: SPV Strategies for 506(b) Fund Administrators

Investing in a 506(b) fund through a Single Purpose Vehicle (SPV) is an attractive proposition for

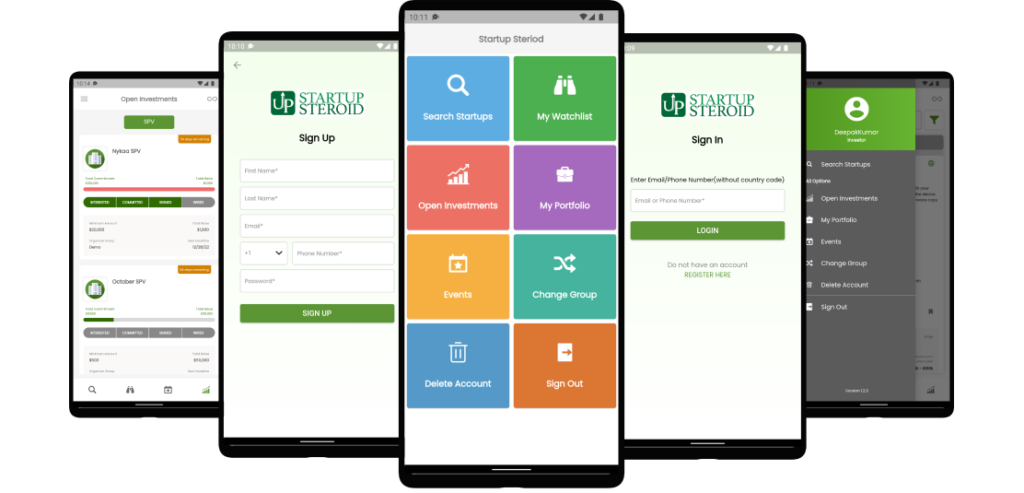

See how Startup Steroid is single-handedly revolutionizing Deal Flow Management, Deal Syndication and Investor Engagement

Re-imagine how Startup Investments take place. Move your Startup investment journey to smaller screens – explore 1000+ Startups, build a watchlist, invest in SPVs, take part in live pitch ratings, and receive event updates.

Learn what Startup Steroid products can do for you.

See how we bring every element of startup deal making journey together. Register now to see for yourself.

Efficient Deal Management

Streamline deal flow, track investor activities, and manage deals in one centralized platform, saving time and effort.

Enhanced Investor Engagement

Gain insights into investor activities, track commitments, and ensure seamless communication to strengthen investor relationships.

Organized Startup Screening

Screen and evaluate startup opportunities, access open SPVs, and make informed investment decisions to diversify your portfolio.

Convenient Investment Process

Simplify the investment process by easily participating in open SPVs, completing investments securely, and tracking your investment portfolio.

Centralized Deal Management

Bring all your startup deals onto one platform, streamline deal flow, and efficiently manage pitch day events for startups and investors.

Enhanced Collaboration

Foster collaboration among startups, and investors, creating a dynamic ecosystem that accelerates startup growth and funding opportunities.

Learning and Networking Opportunities

Provide students with real-world deal flow experiences, create pitch day events, and connect them with angel investors and mentors.

Engage Alumni Investors

Keep alumni engaged by involving them in deal flow and pitch day events, fostering networking and potential investment opportunities.

Faster SPV Creation

Utilize technology to streamline SPV creation, automate compliance tasks, and accelerate the process of closing investments.

Improved Fund Management

Efficiently manage multiple SPVs, track performance, and streamline communication with investors, ensuring a smooth and organized fund management process.

Behind the word mountains from the countries Vokalia and Consonantia, there live the blind. texts. Separated they.

Investing in a 506(b) fund through a Single Purpose Vehicle (SPV) is an attractive proposition for

In the dynamic and intricately structured world of investment and fundraising, the financial toolkit is diverse

Navigating the high-stakes world of private equity investment requires not only keen foresight and business acumen

Exit strategies are essential when it comes to start-up founders and angel investors. By having a